CORPORATE TRANSPARENCY ACT COMPLIANCE

Who, What, When and How

If you are a member of a limited liability company or similar entity, you have probably heard people talking about the Corporate Transparency Act and have been asking … Does this apply to me? How will this new law impact my business? Here we take a closer look.

What is it?

The Corporate Transparency Act (“CTA”) was established by the Anti-Money Laundering Act of 2020 in order to help prevent money-laundering, corruption, tax fraud, terrorist financing, etc. Effective January 1, 2024, “reporting companies” are required to report information about their beneficial owners and company applicants to the Financial Crimes Enforcement Network (“FinCEN”) in a Beneficial Ownership Information Report (“BOI Report”).

Who must report?

A “reporting company” is required to comply with the CTA if it is:

- a corporation, LLC, or was otherwise created in the United States by filing a document with the Secretary of State or similar office under the law of a state or Indian tribe

- a foreign company and was registered to do business in any US state or Indian tribe by a filing. Note that 23 types of entities are exempt from BOI reporting, including, but not limited to, banks, credit unions, insurance companies, and inactive entities.1

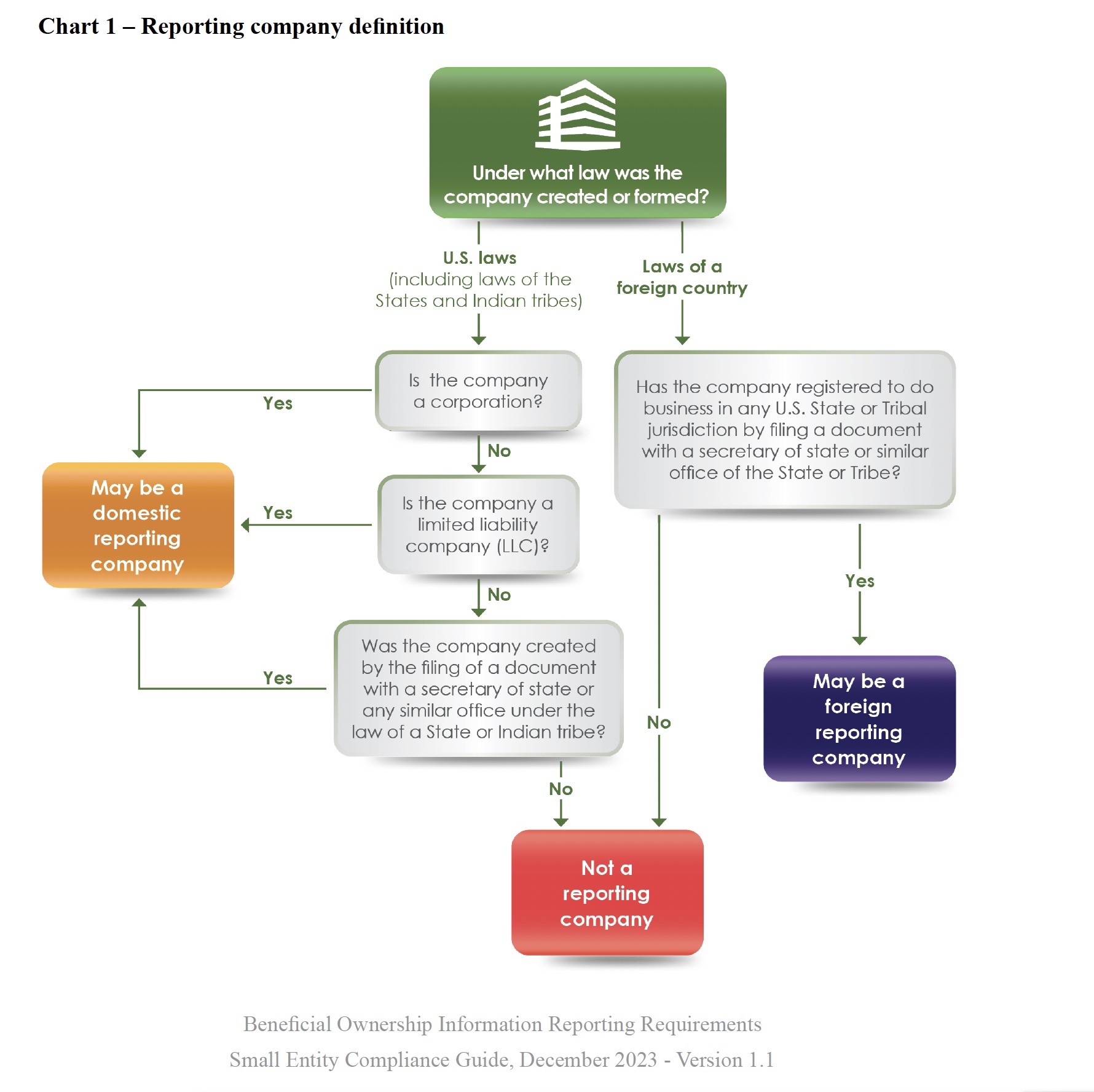

To clarify further, this chart illustrates if your company is required to file a BOI Report with a few “yes” or “no” answers:

If the entity is determined to be a “reporting company” and, therefore, required to comply with CTA, the question turns to ownership and who is considered a beneficial owner who must be disclosed. Subject to certain exceptions (including, but not limited to, minor children or custodians/agents), a “beneficial owner” is an individual who directly or indirectly exercises substantial control over the reporting company or owns at least 25% of the reporting company’s ownership interests.

For entities created on or after January 1, 2024, BOI Reports must also be filed for company applicants. A “company applicant” is:

- the individual who directly filed the document creating the reporting company, and

- the individual who was primarily responsible for directing or controlling the filing of the creation or first registration document. If more than one individual is involved in filing of the creation documents, then two applicants must be reported, but there cannot be more than two company applicants.

When is the deadline?

Under the CTA, reporting companies are required to file BOI Reports pursuant to the following deadlines:

Date reporting company created or registered

Deadline to file BOI Report

Prior to January 1, 2024

January 1, 2025

During calendar year 2024

Within 90 days after receiving actual or public notice that its creation or registration is effective

On or after January 1, 2025

Within 30 days after receiving actual or public notice that its creation or registration is effective.

How to submit a BOI Report and how often?

Reporting companies can electronically file BOI Reports for its beneficial owners and, if applicable, company applicants, through FinCEN’s free secure filing system via FinCEN’s BOI E-Filing. This is a one-time filing with the following exceptions:

- if there has been a change to the information about the company or its beneficial owners

- if there are any inaccuracies in the report

- if it becomes exempt after having filed a report

In such cases, reporting companies will have 30 days to file updated BOI Reports. Note: No updated BOI Report is required about company applicants.

Reporting companies, beneficial owners, and company applicants may also apply for a FinCEN identifier. This unique identifying number can be used on a BOI Report in place of certain information about a beneficial owner or company applicant. Similar to BOI Reports, the FinCEN identifiers must be updated if there are changes to the information about a reporting company, beneficial owner or company applicant.

Are there penalties for non-compliance?

If a reporting company willfully fails to report complete or updated beneficial owner information, or willfully provides or attempts to provide false or fraudulent information, it may be subject to civil or criminal penalties. This may include $500 for each day the violation continues or imprisonment for up to 2 years and/or a fine of up to $10,000.

Who can help?

In order to help reporting companies comply with the requirements of the CTA, FinCEN has a number of resources which may be accessed on a dedicated BOI section of the FinCEN website. Such tools include the Small Entity Compliance Guide, FAQs and contact information. Reporting entities are permitted to use third party service providers to submit their BOI Reports.

1. The complete list of exempt entities can be found in 31 CFR § 1010.380 or section 1.2 of FinCEN’s Small Entity Compliance Guide.